Engage

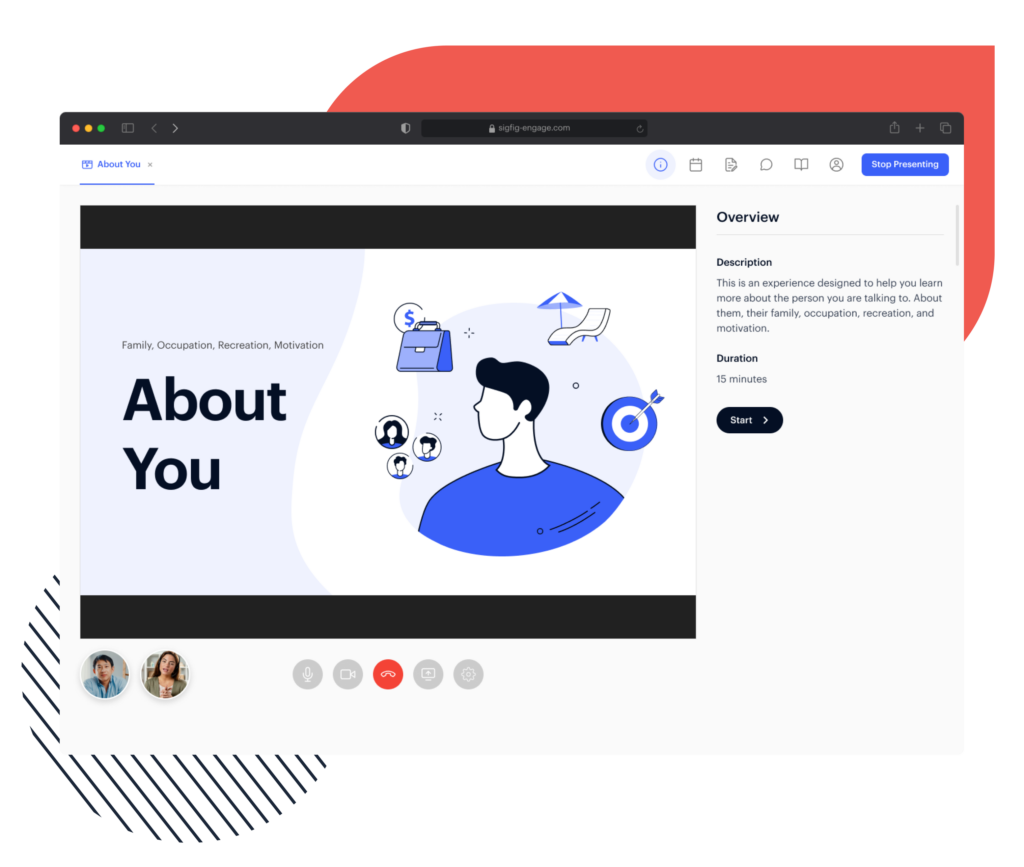

Purpose-built to bring clients closer to their financial institutions through collaborative, remote or hybrid client experiences.

Unlock Provider Efficacy and Meet Client Expectations

We believe that virtual advisory will soon become the predominant way the mass affluent investor segment is served. Elevate your client interactions with our innovative digital platform designed specifically for financial advisors, delivering personalized, efficient, digital advice and effective virtual and in-person experiences

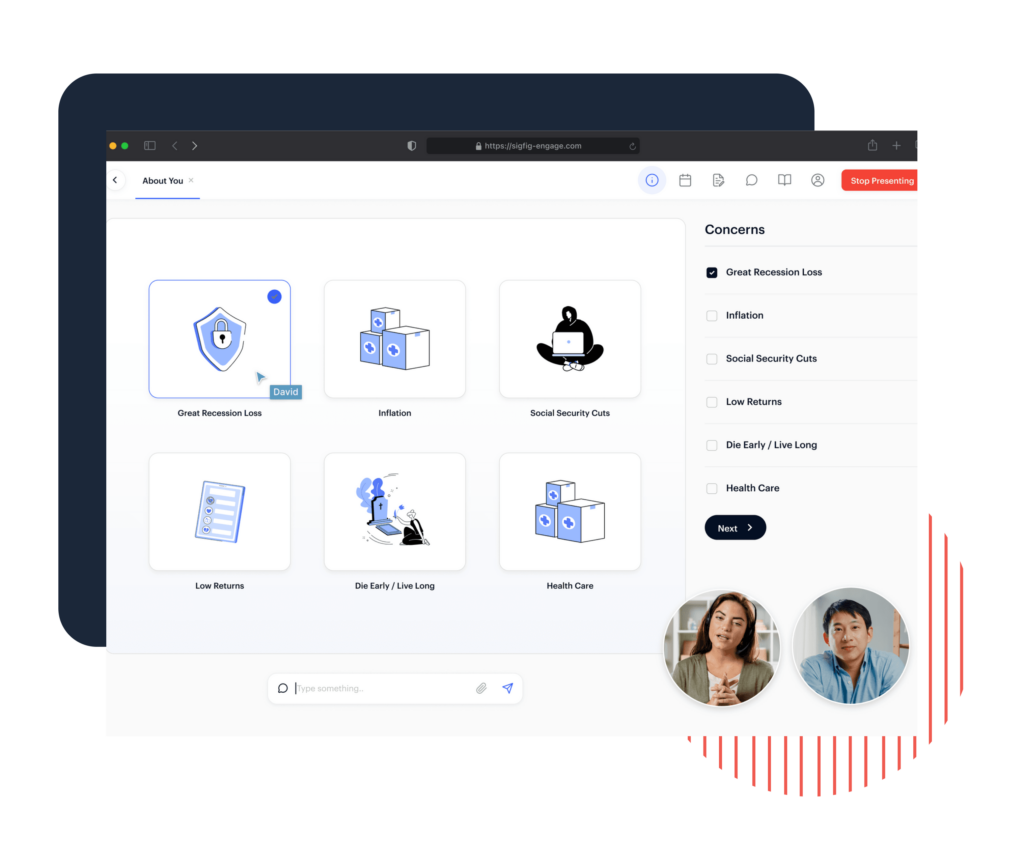

Personalized Interactions

Foster more engaging and meaningful interactions through content displays customized to each client’s information

Streamlined Integrations

Connect with clients and streamline the referral process through integrations with widely used tools such as Google Calendar, Outlook and Salesforce

Seamless Workflows

Real-time Information Exchange

Share and receive data in real-time, with meeting notes seamlessly saved in Salesforce

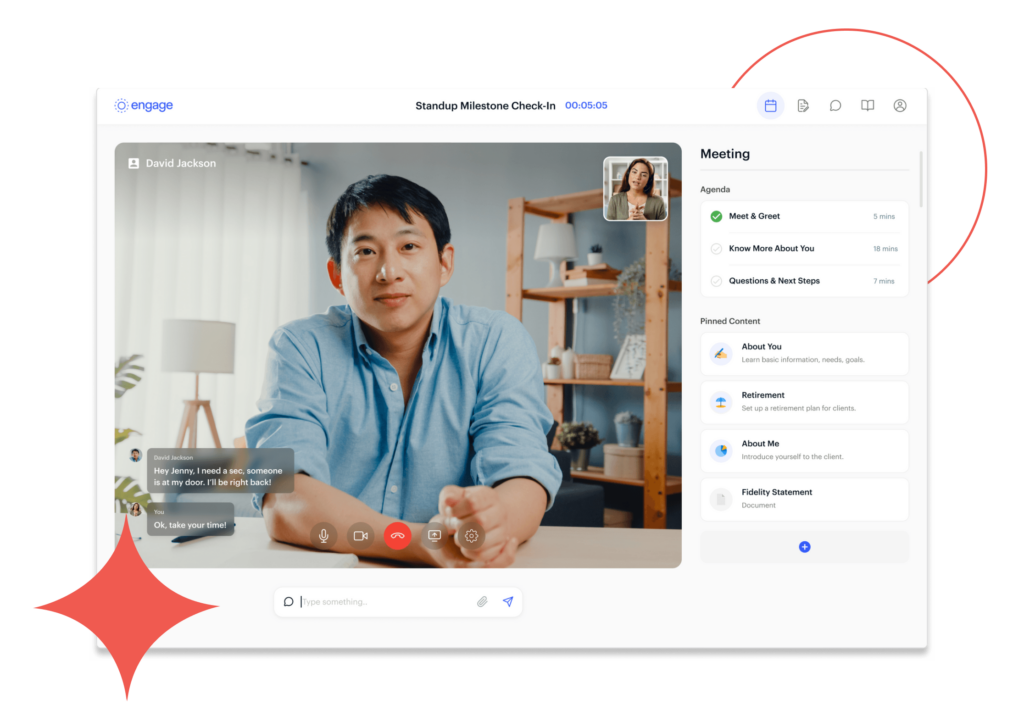

Immersive Collaboration and Advisory Solutions

Discover SigFig Engage, a cutting-edge digital platform that empowers financial providers to connect and collaborate with clients more efficiently and effectively, virtually and in-person.

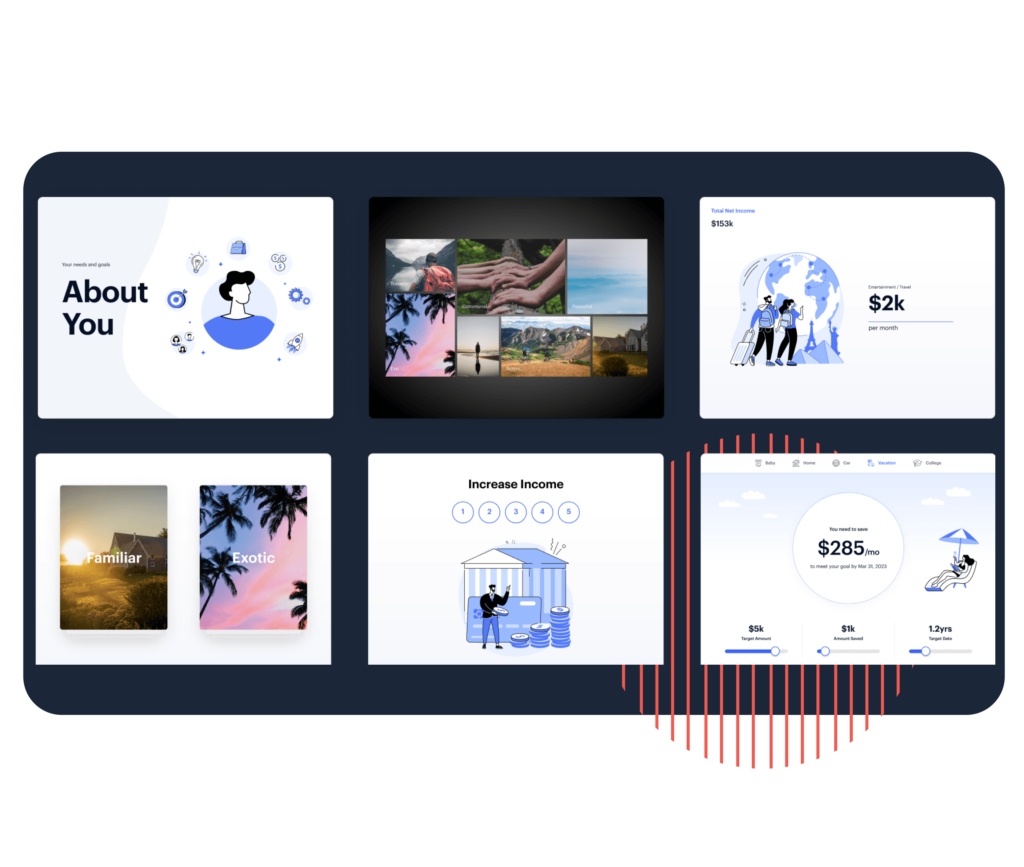

Guided Discussions

Consistent Advice Delivery

Create a uniform experience for advisors and clients with structured check-ins and personalized topics.

Customized for Financial Institutions

Cater to the unique roles and use cases within the financial industry, with specific roles for bankers, advisors, and clients.

Competitive Differentiation

Can you imagine saving 30 days a year to deepen client relationships?

Download our math, Maximizing Reach and Efficiency: How SigFig Can Help Empower Financial Advisors, to learn how you can enable your teams to spend time on what matters most.