Digital Wealth Platform

A complete set of digital wealth solutions for your mass affluent clients and emerging investors.

Holistic Digital Wealth Solutions

Deliver value to your clients and advisors alike through unique digital advice-centric experiences.

Shared Platform Features

Digital Wealth Core

Investment Management

- Custodian flexibility

- Model flexibility

- Investment recommendation & selection

- Automated trading & rebalancing tax efficiencies

- Aggregation supported funding

Client Experience

- SSO into client portal/OLB

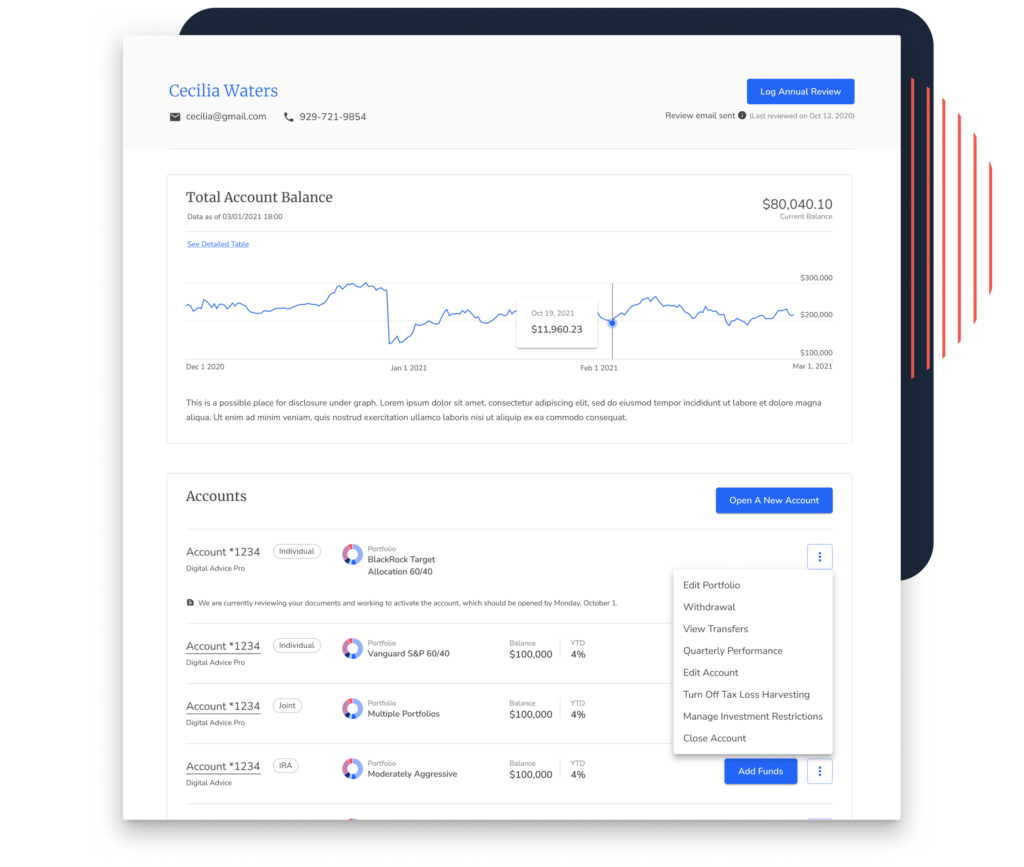

- Self-service client dashboard

- Automated email programs

Home Office

- Fee flexibility

- Service & operations dashboard

Features to Support Advisor-Led

Digital Advice Pro

- Advisor CRM/Workstation Integration

- Advisor-led Profiling & RTQ

- Role-based Investment Selection Flexibility

- Portfolio Blends

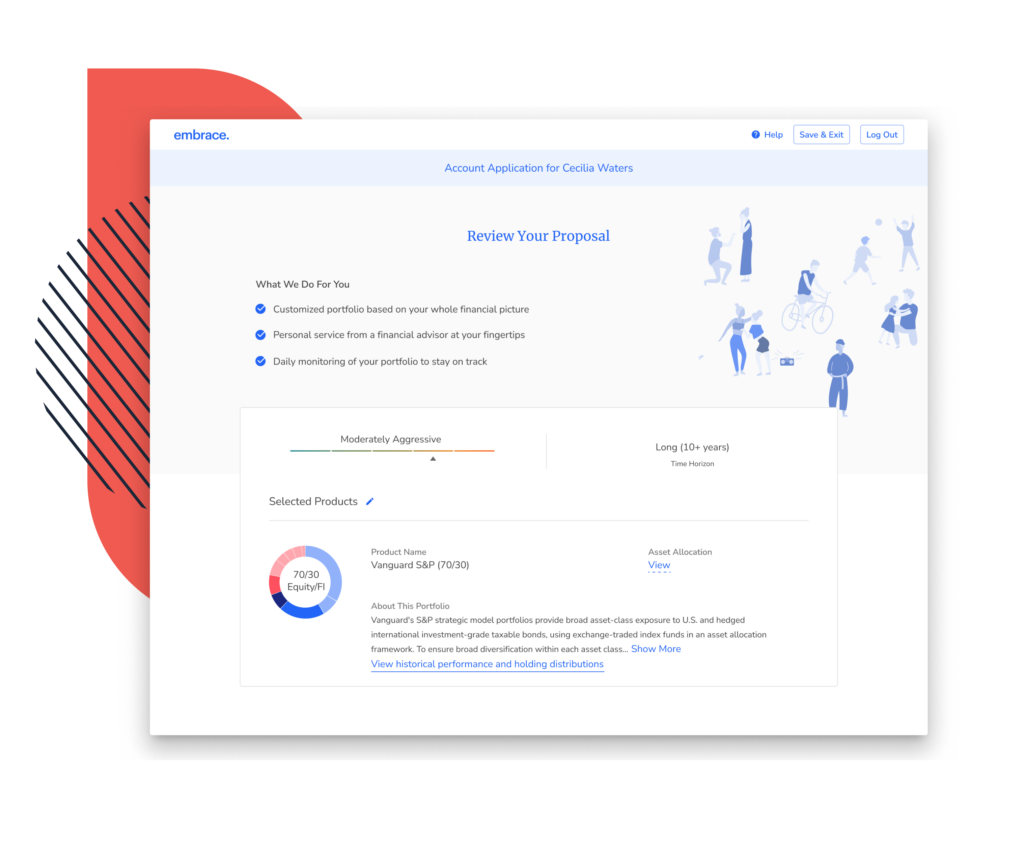

- Advisor Proposal Tool

- Automated Advisor-led Onboarding

- Advisor Dashboard

Features to Support Investor-Led

Digital Advice

- Program marketing page

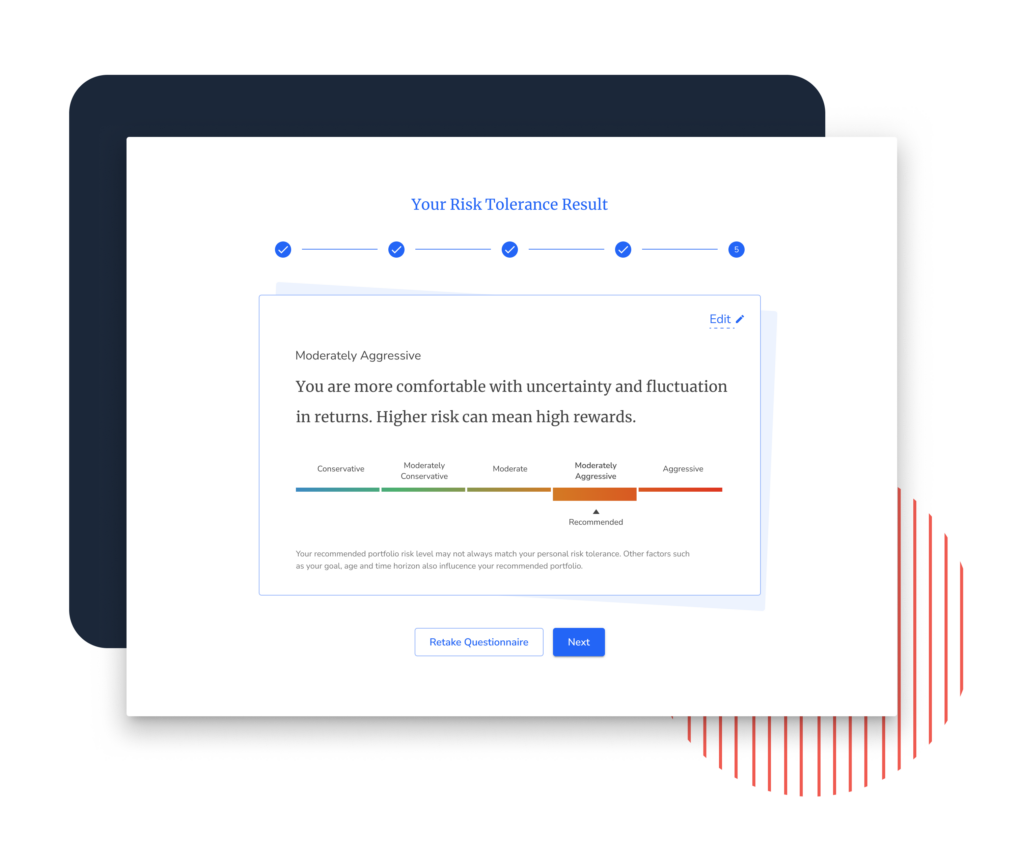

- Client-led profiling & risk tolerance questions

- Fully digital account opening

Remote Advice Delivery and Fulfillment

Engage

Collaboration

- Multi-participant collaboration between client and advisor

- Client needs discovery

- Advice nudges

- Pre and post meeting planning and follow-up

Integrations

- Integrated client information via CRM integration

- DocuSign for easy eSignatures

- Accepts self custody and 3rd party custody

Tech Features

- Virtual meeting portal: audio, video, screenshare

- Meeting transcription / recording

- Client scheduling

- Document / image upload and file sharing

The Right Technology Unlocks Revenue

We offer a complete set of open architecture digital wealth solutions for your mass affluent clients. With flexible integration and implementation models to streamline each step of the process — from goal planning & risk assessment to client & advisor dashboards — SigFig is one platform to connect them all.

The right technology can reduce both time and cost

Serve Your Clients on Their Terms

Advisor Empowerment

Equip advisors with an intuitive platform for efficient client management and servicing.

Modern Enterprise Technology

Secure and scalable digital wealth management solutions for financial institutions of all sizes.

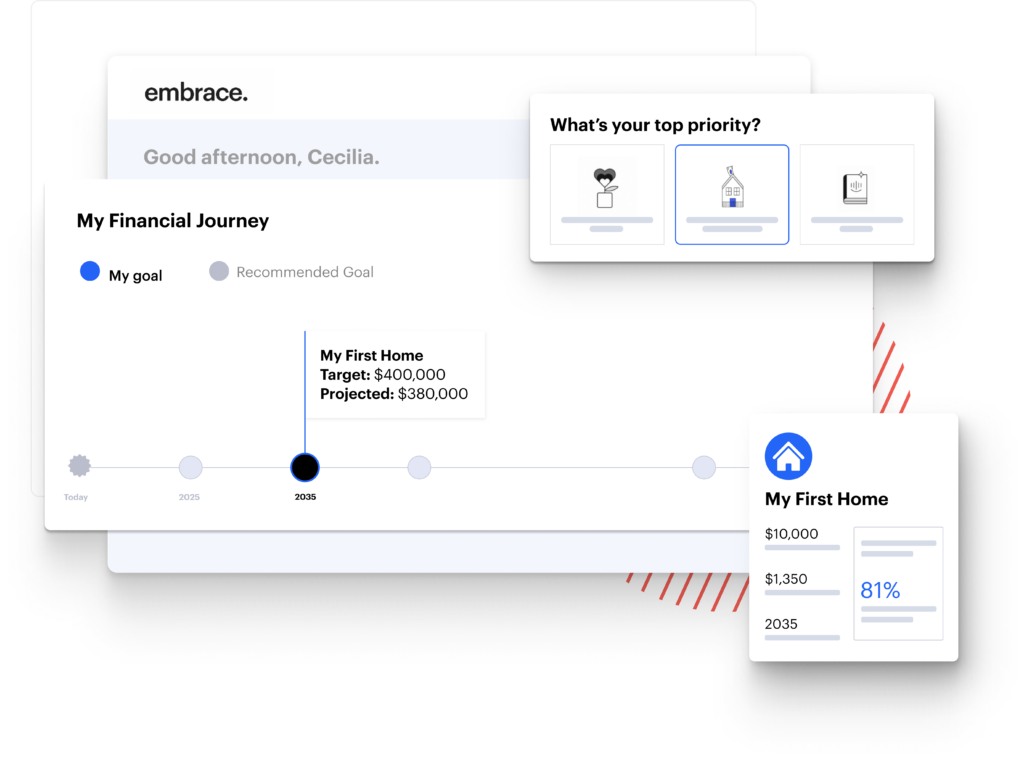

The Future is Financial Wellness

SigFig Digital Wealth is designed around strategic pillars, structured to drive financial wellness for your clients. Customers don’t seek out financial planning tools — they seek partnerships that can help them feel understood and confident in their goals, and to make progress. Enable your advisors to deliver this type of seamless service.

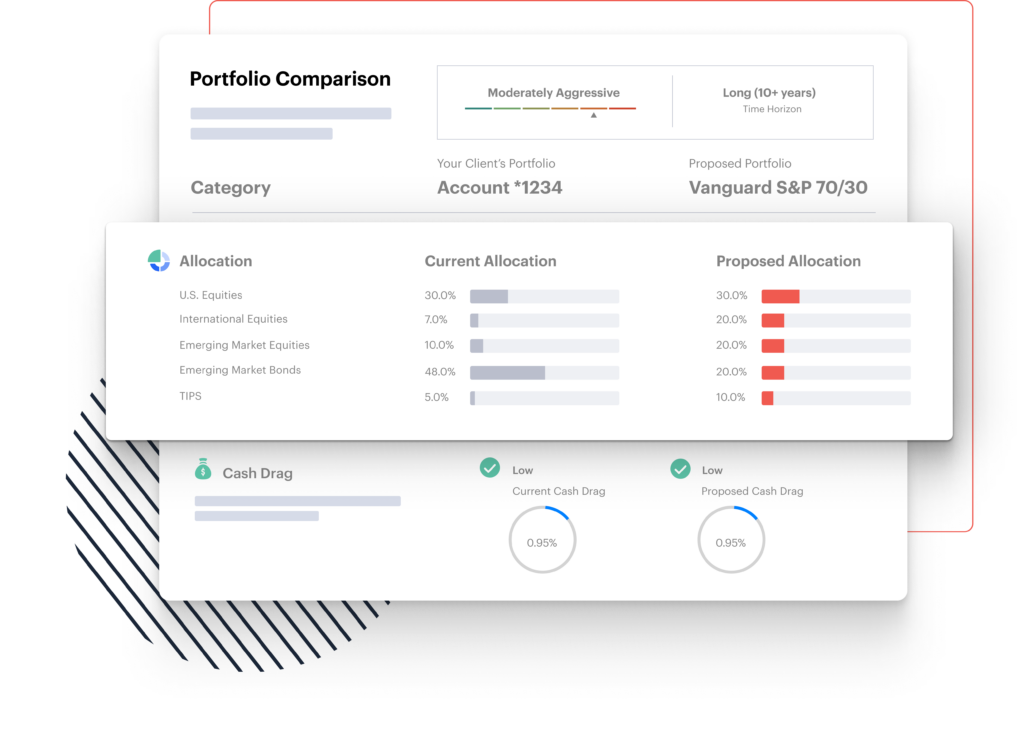

Portfolio Compare

Rapidly identify portfolio adjustments for faster goal achievement in your client’s financial journey.

Goals Tracking

Digestible goal info enables advisors to guide productive planning conversations with clients.

Plaid Account Aggregation

Provide one view of your client’s financial accounts through our Plaid integration.

Can you imagine saving 30 days a year to deepen client relationships?

Download our math, Maximizing Reach and Efficiency: How SigFig Can Help Empower Financial Advisors, to learn how you can enable your teams to spend time on what matters most.

Industry Insights