New Opportunities to Drive Advisor Efficiency and Client Experience:

Lessons Learned from Robo-Technology

There has been a lot of speculation recently about the future of robo-advisors.

News headlines question whether recent M&A activity signals that future expansion of robo- or digital advice is slowing. Despite these somewhat ominous headlines, robo-advice continues to grow at a healthy pace. In our recent roundtable discussion on emerging trends and opportunities in the digital wealth space, we discussed ways that the technology that paved the way for robo-advice is now being used to create new opportunities for financial advisors.

We strongly believe the new path forward for digital advice will combine human advisors with robo-technology to create more streamlined digital experiences for clients across multiple segments. While there is still a space for digital-only solutions, we see an emerging middle space in serving mass aluent customers that prefer a technology-led approach but still want the touch of a human advisor. We are helping our financial institution partners leverage our robo-technology platform to build advisor eiciency and eectiveness to reach this fast growing segment through a hybrid approach, blending technology with human advice. We see tremendous growth potential for this model going forward, particularly with the next generation of aluent investors.

How Robo-Advisors Are Making Wealth Management More Accessible

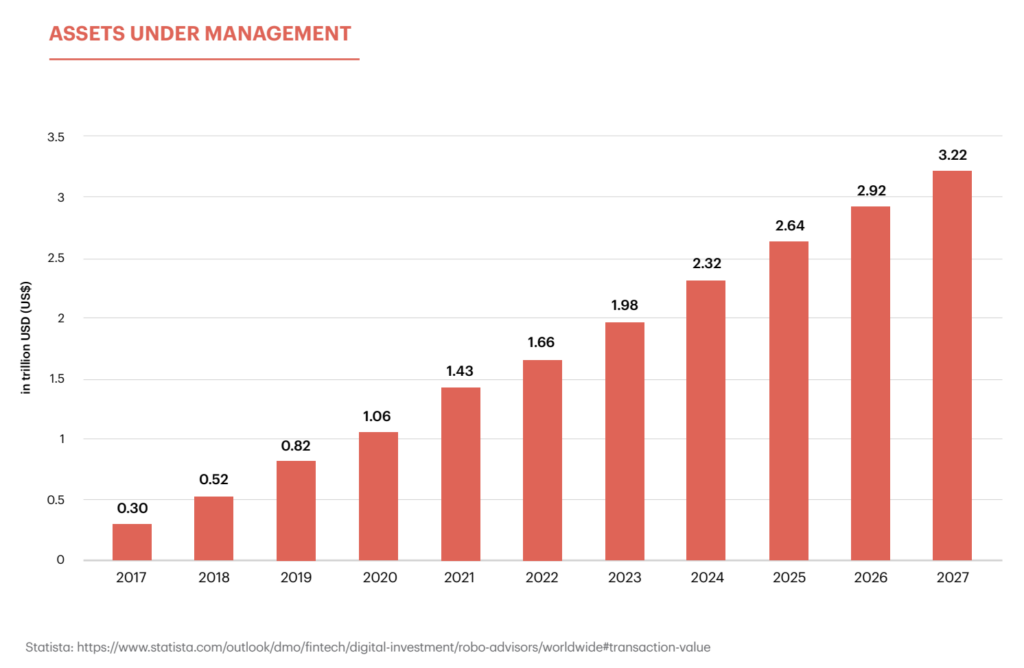

Over the last five years, assets under management at robo-advisors have increased from $300 billion to $1.66 trillion, and are expected to grow to 3.22 trillion by 2027.1

Further, in a recent study of nearly 1,600 Americans, nearly 2/3 indicated that they are open to using a robo-advisor to manage their investments, with millennials being the most open, with 75% expressing interest.

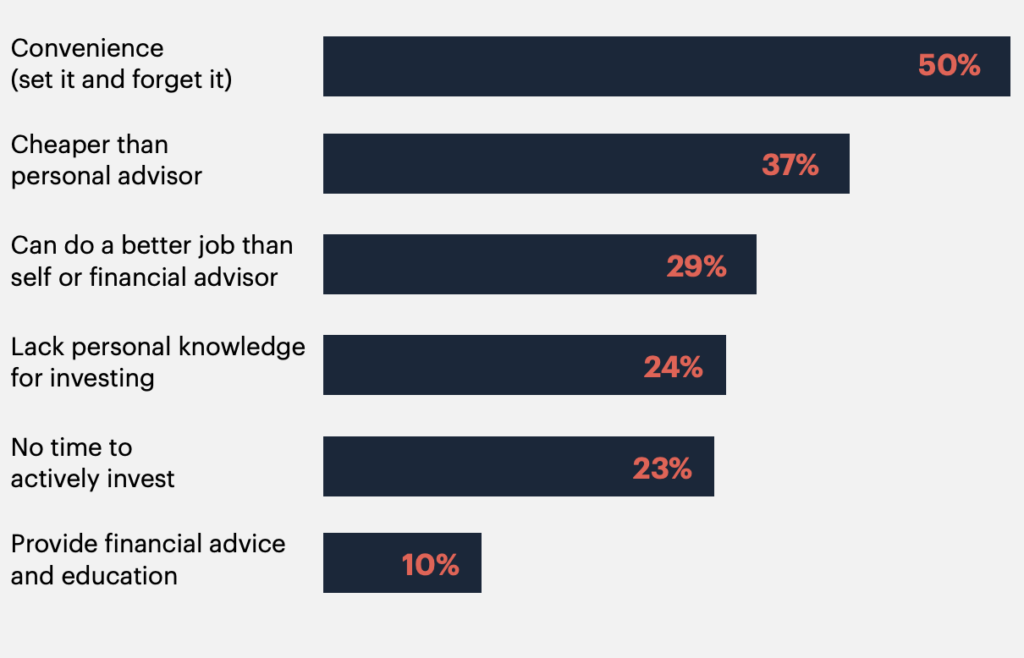

Reasons for Using Robo-Advisor

Now, Market Conditions Are Leading to New Opportunities for Robo-Technology

Even as robo-advice solutions gain market share, there is opportunity to reach a larger population of investors that prefer a human connection, particularly in more challenging economic environments like these.

A recent survey showed that about half of investors agreed that it’s better to work with a financial advisor when there is volatility in the market. According to another survey by Accenture, roughly a third of 1,000 respondents expressed that they would increase their investments with an advisor if they received a hyper-personalized experience. The percentage is higher with younger investors.

The Evolution of Robo-Technology: Empowering Advisors to Reach a Larger Audience

Omnichannel access is no longer just ‘nice to have.’ Digital is the most preferred channel for clients, closely followed by remote (including wealthier and older clients previously less digitally inclined).

Robo-technology can be leveraged to transform how advisors engage and service clients and open up new opportunities to expand their reach across multiple client segments and expectations.

By tapping into the same technology behind robo-advice, advisors can deliver all of the bene its of robo-advice to a broader universe of investors that want the option of a human touch, while firms bene it from being able to reach the rapidly growing mass affluent segment in a more efficient, economical way.

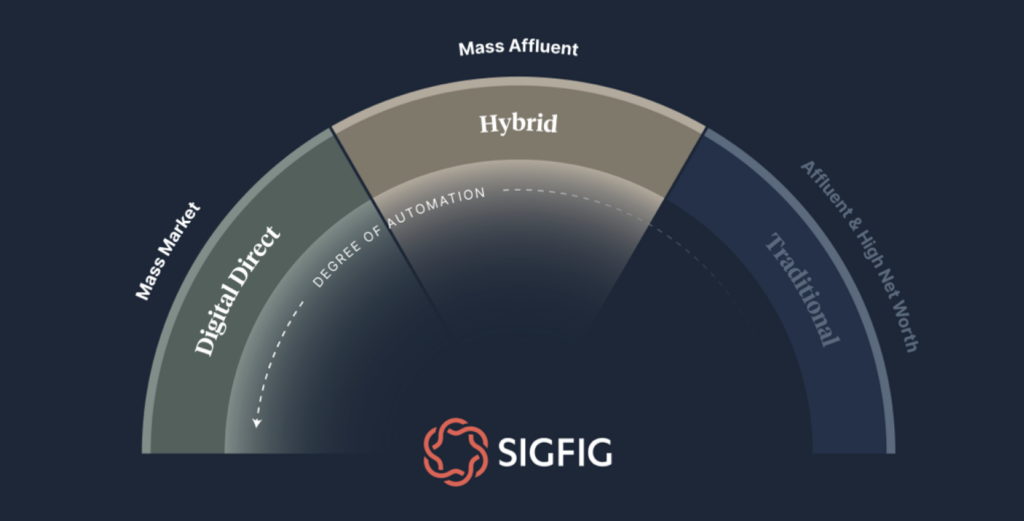

We see a wealth of opportunity in serving the emerging market of hybrid coverage, where investors that want and need a human advisor but don’t require the same degree of sophistication required for the traditional 1:1 advisory relationship served by field coverage.

According to McKinsey, one-third of mass affluent households ($250K-$2MM), are now using a hybrid

model, or using both automated technology and in-person advice to manage their investments, making it the fastest growing segment of affluent investors. The rapid growth is a result of two trends that are expected to persist: investors’ desire for human advice and the ease and affordability of direct investing.

On the left of the spectrum, investors just getting started or with smaller amounts to invest can be serviced by a fully digital direct experience, with “humanized” advice layered into the experience. This could be access to a team of advisors when they have questions and/or access to a robust library of educational content and well-designed automated communications.

Some firms are also considering migrating legacy advisory accounts that haven’t grown sufficiently to a fully digital experience to improve efficiency. Migrated accounts can save a firm 20 to 50 bps depending on internal cost and current service models. This is best done in a segmented phased approach, and may require new service models (virtual advice and client service teams) in order to successfully implement this strategy.

How Robo-Technology Can Help Advisors Improve Efficiency (or Save Time)

According to Cerulli, advisors spend more than 50% of their time on non-client facing activities like investment research, due diligence and monitoring, trading and rebalancing, and managing day-to-day operations.7 SigFig can greatly improve efficiency in the majority of these areas by incorporating automation and other tech-enabled functions into your firm’s new client onboarding and servicing processes.

The more efficient the business, the lower the fees charged to clients, which can increase the size of your prospective client pool. By leveraging technology and automation, the advisor can be more “hands off” with service and administration, and provide more clients the personalized service they are looking for, at a reduced cost.

Fintechs can help banks transform the way advisors interact with customers by automating work lows and streamlining the amount of work needed for onboarding, planning and monitoring. Onboarding can be particularly time-consuming with activities like meeting prep, account setup, and data entry. Advisors are often dealing with multiple systems that don’t talk to each other. The amount of time lost working across different systems can be staggering.

We estimate that SigFig’s technology can save over 30 minutes per account in onboarding and account opening by simplifying proposal development and investment selection and streamlining data low through a single platform, regardless of whether advice is delivered remotely or in-person.

SigFig also estimates that it can save an average of 20 minutes per account in annual maintenance by automating deposits and withdrawals, tax and statement requests, account updates and automating annual review compliance requirements.

Contact us for more details on how SigFig could help you reduce time spent across different parts of the customer lifecycle and improve margin.

How We Automate

SigFig uses technology to automate a variety of tasks behind the scenes in onboarding, investment management, monitoring and reporting to save advisors’ time, including:

Painless onboarding

Advisors can also lean on automation software to streamline mundane activities like onboarding new customers, completing forms and gathering needed documents. It can also help to reduce costly errors. A personalized portfolio is typically opened in less than 10 minutes.

Automated investment management

Features like automated daily health checks and automatic rebalancing can help manage an investor’s portfolio to align with their goals and risk preferences behind the scenes, taking the burden of constant checks off of the advisor. Automated tax-loss harvesting can also be done behind the scenes to help limit the impact of taxes for clients, saving advisors time and energy.

An integrated client portal for transparency

Innovations in planning software allow investors and their advisors to consolidate holdings onto one platform to see their entire inancial picture in one place. Monitoring, research and goal tracking can be made easier.

Automated annual reviews and communication

Time savings from preparing and conducting annual reviews and portfolio updates empower advisors to reach more clients with personalized engagement and communication.

Convenient collaboration

The advantage of clean digital interfaces isn’t reserved for robo-advisory platforms. Digital customer experiences can be effective communication tools for traditional advisors too, facilitating client interactions and financial planning. And it’s not just a conversation, virtual conference solutions can help with walking through portfolio decisions, signing documents, aggregating data, etc.

Wrap Up

As servicing becomes more efficient, advisors can service more investors at a lower price point, and this opens up advisor-led service to many new investors that don’t want to pay the price of a 1:1 relationship. Virtual advice can transform the way that the mass affluent audience is served. It saves time for both the advisor and client, provides convenience, and allows for collaboration during discovery and planning, unlocking the capacity of the advisor and extending their reach.

Connect with us on Linkedin or via marketing@sigfig.com to learn more about our products and how we power some of the largest financial institutions in the US and Canada to deliver a modern advice and service experience.